Construction equipment depreciation calculator

Equipment managers must take a long-term view of the repairrebuildreplace decision in order to optimize the value of equipment assets over their full life cycle. We then need to subtract the original cost of the equipment 103000 from that number to find our net profit over 5 years.

Depreciation Formula Calculate Depreciation Expense

The Annual Effects of Depreciation.

. The Hourly Depreciation is the depreciation cost in respect of new machines chargeable to the work on hourly basis is calculated using Hourly depreciation 09 Book Value Life SpanTo calculate Hourly Depreciation you need Book Value C bv Life Span L sWith our tool you need to enter the respective value for Book Value Life Span and hit the calculate button. We do work we put completed construction in place. The first step to figuring out the depreciation rate is to add up all the digits in the number seven.

Based on Excel formulas for SLN costsalvagelife. It costs money to do this work box 2 which includes labor materials subcontractors indirects and of course equipment box 3. Wise investments and wise decisions pay off.

If you have construction equipment that you bought for 200000 you can use the depreciated value at 18000 for every year adding up to a total of 180000. 7 6 5 4 3 2 1 28. Builders save time and money by estimating with Houzz Pro takeoff software.

Ad Submit accurate estimates up to 10x faster with Houzz Pro takeoff software. Box 1 shows the beginning of the cycle. Remember that salvage value is just an estimate.

Also includes a specialized real estate property calculator. Straight Line Asset Depreciation Calculator Enter the purchase price of a business asset the likely sales price and how long you will use the asset to compute the annual rate of depreciation of that asset or piece of equipment. The calculator should be used as a general guide only.

This paper analyzes methods of depreciation expenses calculation as well as their impact on the overall expanses of construction machinery and the impact on the cost per unit of material. Calculator Savings Result Amount Annual Depreciation Todays Redmond Savings Rates. They should not worry too much about short-term fluctuations.

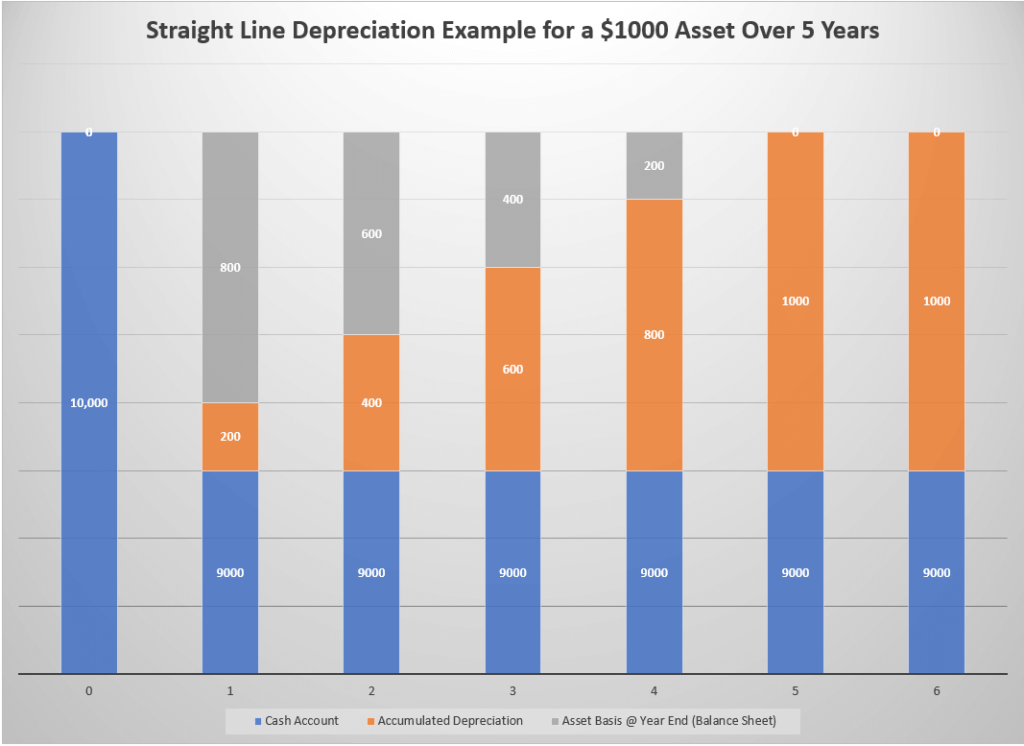

Ad Lightning-fast Takeoff Complete Estimating Proposal Software. Calculate depreciation used for any period and create a straight line method depreciation schedule. To calculate a rental you would multiply the total cost of a piece of equipment x 5 month x 13 x 80 to arrive at the estimated annual rental dollars a rental company wants to achieve.

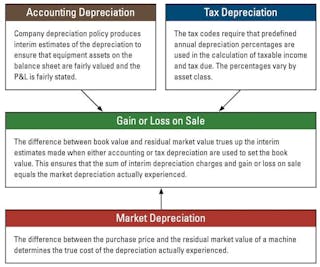

Quickly Perform Material Takeoffs Create Accurate Estimates Submit Your Bids. We understand the importance of accuracy and timeliness with your business and tax needs and we make certain that you can rely on us to get the job done right. Lets turn to the diagram and develop a simple pragmatic understanding of a how depreciation works.

According to the formula you should be able to sell the equipment for 20000 after 10 years. Some items may devalue more rapidly due to consumer preferences or technological advancements. In other words the depreciation rate in the first year will be 7 divided by 28 which equals 25.

Next youll divide each years digit by the sum. Eitherbe borrowedfroma lender fromreservefundof Inordertocalculatethe thecontractor costoffinance and thesalvagevalueboth F shoulda significant it willbetaken or the purchase. Up to 24 cash back depreciation costcalculated through the INVEST COST Thepurchase M ENT FFIN of construction COST NC equipment E requires investment Thismoneyofmoney.

There are many variables which can affect an items life expectancy that should be taken into consideration when determining actual cash value. Depreciation calculators online for primary methods of depreciation including the ability to create depreciation schedules. 391126 103000 288126 Given a 60 utilization your net profit from the machine rented at both a 135 and 150 boom is 288126 and you can expect to pay off the price of the machine in 15 years.

Depreciation Schedule Formula And Calculator Excel Template

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Examples With Excel Template

Vgjkjvn03c Bnm

Financial Accounting Depreciation Calculation Fixed Assets Sponsored Fixed Asset Financial Accounting Learn Accounting

Accounting For Equipment And Depreciation Simple Business Plan Template Small Business Tools Positive Cash Flow

Pin On Projects To Try

Depreciation Schedule Formula And Calculator Excel Template

What Is Equipment Depreciation And How To Calculate It

Depreciation Schedule Formula And Calculator Excel Template

Safety Checklist Examples Safety Checklist For Office Construction Safety Checklist Excel Building S Safety Checklist Checklist Template Fire Safety Checklist

Depreciation Formula Calculate Depreciation Expense

Depreciation Of Building Definition Examples How To Calculate

4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Economics Lessons Small Business Bookkeeping

Download Depreciation Calculator Excel Template Exceldatapro

What Is Equipment Depreciation And How To Calculate It

How To Prepare Depreciation Schedule In Excel Youtube